thankQ Help

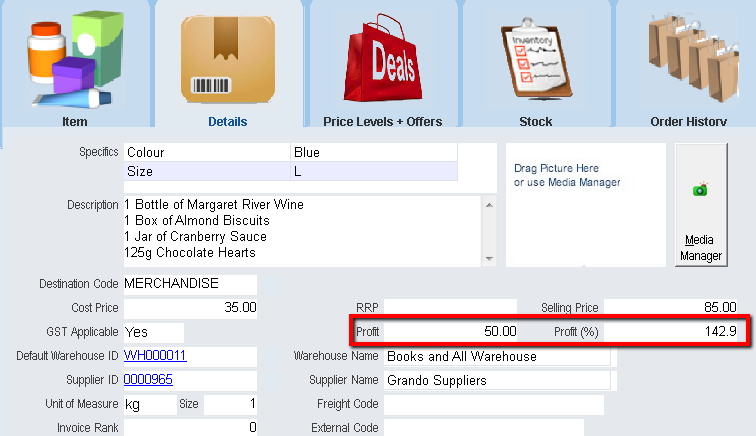

1.On the Details tab, enter the Specifics of the product.

Note that the specifics field is information about the product.

The size entered into the Unit of Measure and Size fields further down the form are used to calculate freight matrix (postage).

2.Enter the Description of the product.

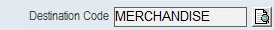

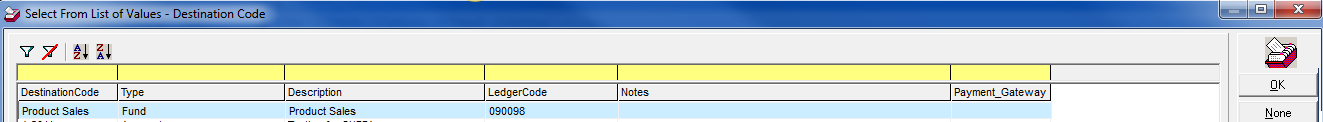

3.Click on the Pick List next to the Destination Code.

|

This is only required if it is different from the code setup with the Source Code. |

4.Locate and select the Destination Code to which the customer payments for this product will be made. Click OK.

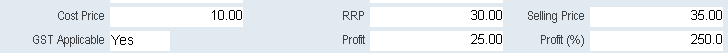

5.Enter the Cost Price, RRP, Selling Price and if GST Applicable

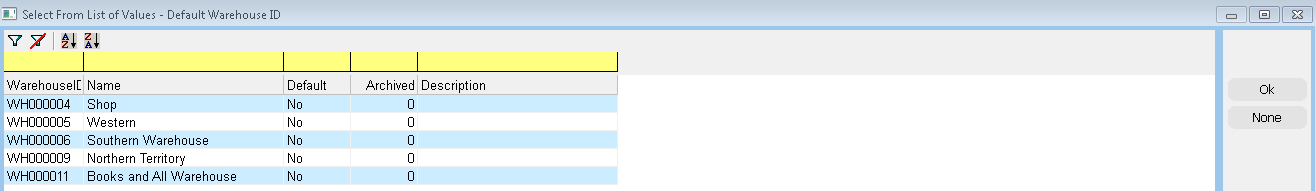

6.Click on the Pick List next to the Default Warehouse ID.

This is the Warehouse that the Product will automatically be allocated to unless you select another Warehouse when you are placing a supplier order.

7.Locate and select the Default Warehouse ID, Click OK.

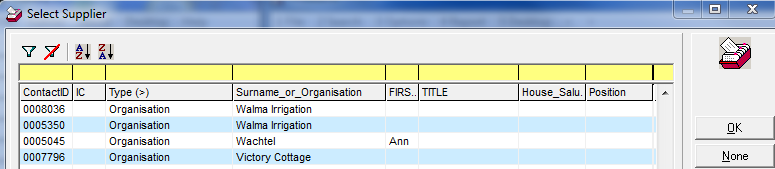

8.Click on the Pick List next to the Supplier ID.

9.Locate and select the Supplier ID, Click OK.

10.Enter the Unit of Measure, Size and Freight Code if required.

|

These values are used as part of postage calculations as defined in the Freight Matrix (see appendix for further instruction) |

11.Enter the Invoice Ranking and External Code if required.

12.Click OK.

Using the Cost Price and the Selling Price entered, thankQ calculates the Profit and Profit(%).