thankQ Help

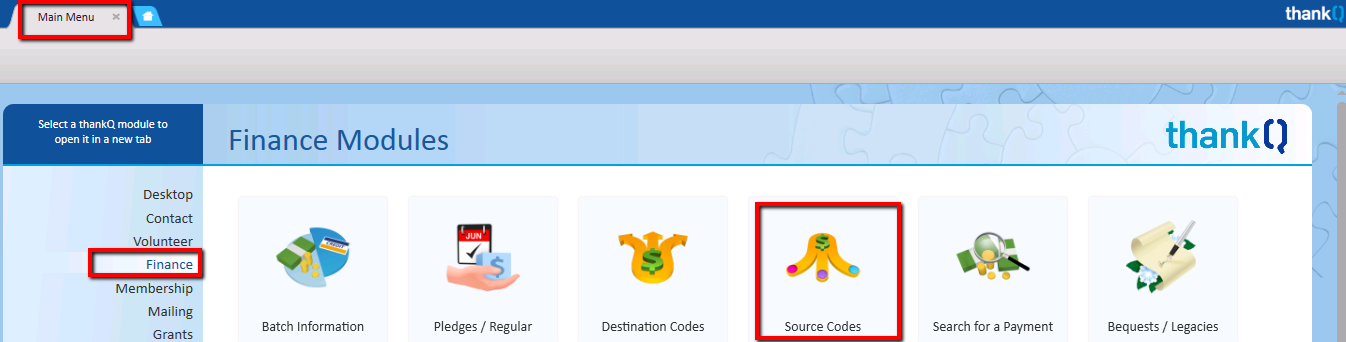

1.Click the Source Codes icon under the Finance module.

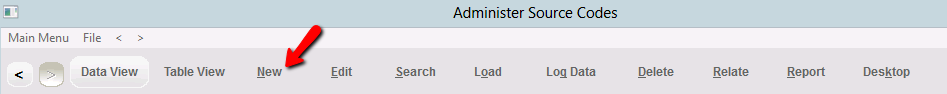

2.Click the New button on the tool bar.

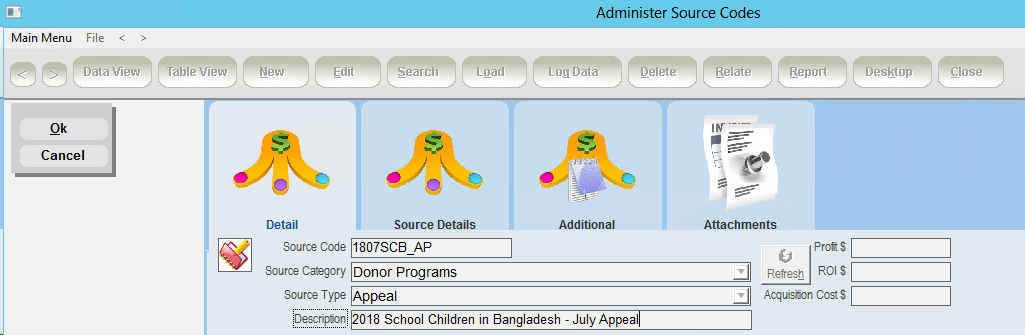

3.Enter the source code into the Source Code field. For example, 1807SCB_AP is abbreviated for 2018 School Children in Bangladesh – July Appeal.

4.Select a Source Category from the drop down.

5.Select the source type on the Source Type menu. The Type can be used to group source codes in reports. This particular source code could be an Appeal type or a Mailing type, depending on how your organisation wants to report.

6.Enter a description into the Description field. For example, 2018 School Children in Bangladesh –July Appeal.

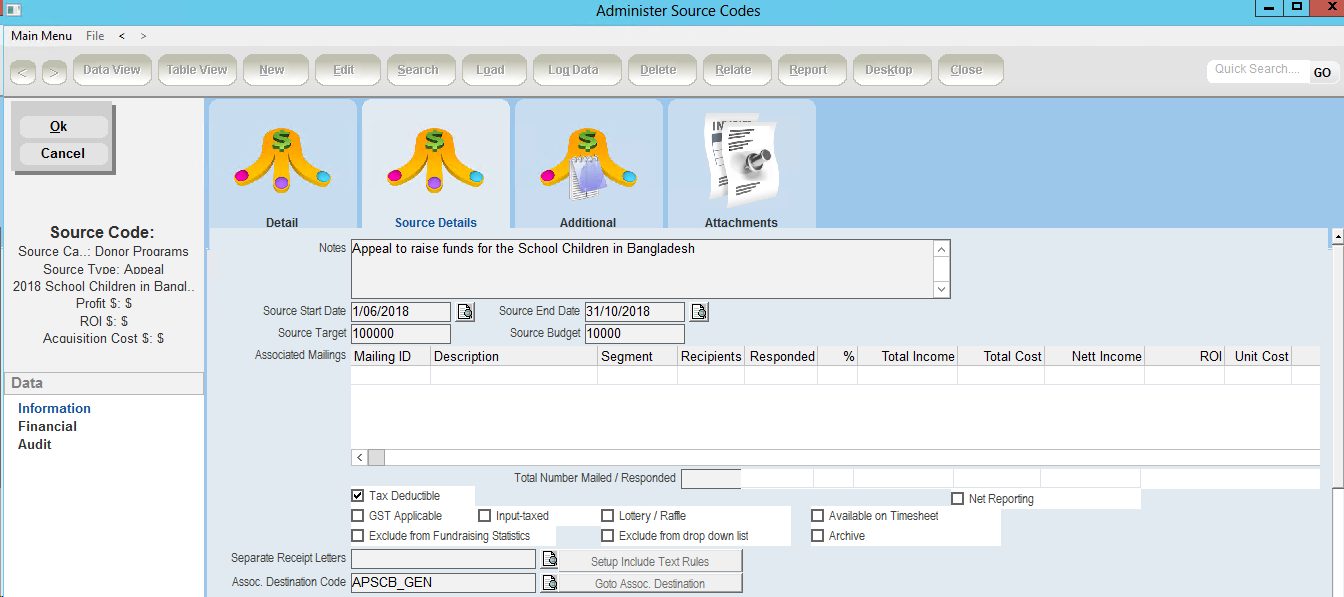

7.On the Source Details tab you can then record further information about the source. The following fields are optional and can be left blank if desired.

Notes |

Any further information as to why the source code is being setup such as describing a project or appeal. This will help in the future so people can understand why this source was set up. |

Source Start Date |

The Start Date of the appeal or campaign. This field can be used for reporting purposes. |

Source End Date |

The End Date for the appeal or campaign. This field can be used for reporting purposes. |

Source Target |

The target for the appeal. How much money are you expecting to raise? |

Source Budget |

The budget for the appeal. This may include operating costs for the mailing / telethon / event. |

Tax Deductible |

This is the default for donations where there is a tax deduction. |

Total Number Mailed / Responded |

This field is automatically updated by thankQ when a mailing is linked to the source code. Click Edit to change the number manually. |

GST Applicable |

This tick box is used where the source incurs GST eg Event Tickets, Merchandise and your organisation is registered for GST. |

Input-Taxed |

Tick this box if no GST is being claimed and the source is being used for fundraising. |

Lottery / Raffle |

Tick this box if the source is a lottery or raffle. |

Available on Timesheet |

If you will be using the Timesheet module, ensure that you tick the Available on Timesheet checkbox on the Administer Source Codes Form. |

Exclude from Fundraising Statistics |

When this checkbox is ticked the payments attributed to this source will not be included in the statistics displayed on the Fundraising tab of the Contact Details form. This becomes particularly relevant in cases of one off giving, such as In Memoriam or In Celebration where a one-off donation could skew the results of regular giving or pledges. |

Exclude from drop down list |

When this checkbox is ticked the source code will not be available in the standard source code pick list. |

Archive |

When this checkbox is ticked the source code will be archived and the source code will not appear on the standard Administer Source Code form. The source code will not be available in the standard source code pick list. |

Separate Receipt Letters |

If setup under lookup values, selecting the type of receipt will segment any mailing. |

Assoc Destination Code |

Enter a default Destination Code. This is a mandatory field. This can be changed when entering payments. |

8.Click the Pick List button to select the destination code from a standard list then click OK. The associated destination code represents the project for which the Source is raising money.

Only tick GST Applicable when the source has a GST component such as Event tickets, Merchandise, Membership etc. GST is automatically calculated.

|

When GST is applied to a source code, these funds will not be included in any reports involving Donations as donations are GST free. |

The Payments tab, Financial Summary tab and Financial Detail tab are for reporting purposes to track how many donations / pledges are being generated by the source.